‘Really tough’: Dark storm hits Aussie business

Written by admin on July 29, 2024

Australian business is slumping.

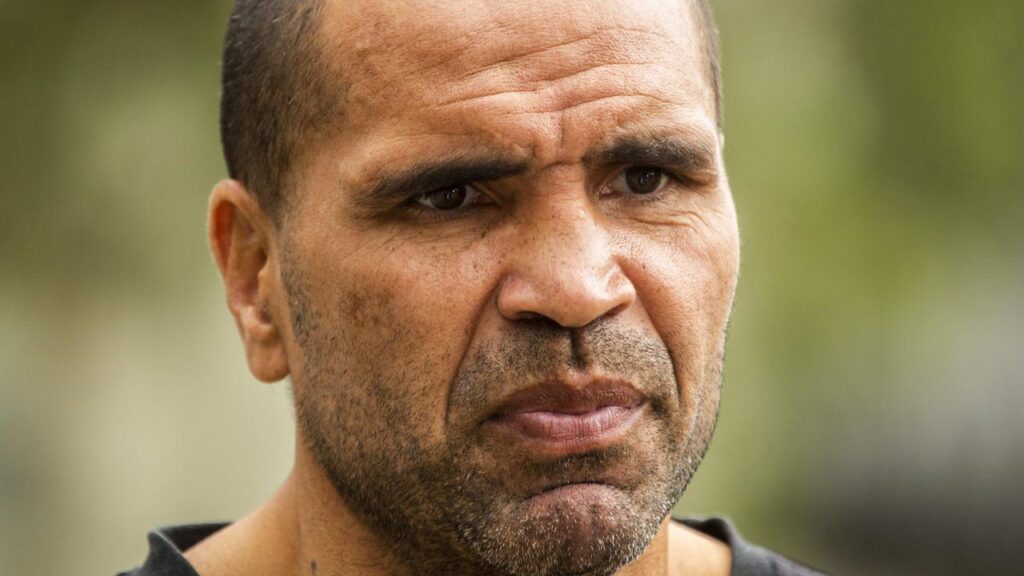

More than 11,000 companies have gone bust in the past year and South Australian cafe owner Michael Beech is at the coalface of the carnage.

“We have a lot suppliers come in and we always have a chat about what the scene is like out there, in the city and in the suburbs,” he said.

“The city is doing a bit better than the suburbs, but I have heard some cafes have just had to close their doors.

“They haven’t been able to put up with the costs.”

Mr Beech runs the High Street Cafe in Adelaide’s inner-east Kensington suburb and he said two storms had hit his business in quick succession: Covid and then a cost-of-living crisis propelled by rising prices and costs.

“It’s been really tough,” he said.

“The issue is, we have lots of casuals in our cafe and the last two years, the casual wages have gone up three times and besides then you’ve got the situation with food,” he said.

“I’ve gone from 30 per cent of my food I used to make, now I’m making 75 per cent of my food because to buy it in, the cost is just way too high.

“When I’m making my food, even my groceries, from your supermarkets, obviously they have gone up, so what happens then, you’ve got to try and find a balance to keep the customers happy.

“If I keep putting my prices up to alleviate the costs I’ve got to incur, then customers find they can’t really afford it.”

The total 11,049 insolvencies recorded in 2023-24, revealed in ASIC’s annual insolvency report, marks a 39 per cent increase in insolvencies compared with 2022-23.

The figure was the highest since the peaks of 2011 and 2012-13, though the proportion of busts were lower because there were now 3.4 million businesses in Australia compared with the two million recorded in 2011-2013, the watchdog said.

“The current ratio of companies entering external administration compared to the number registered (was) 0.33 per cent, still below the 2012-2013 (level of) 0.53 per cent,” ASIC noted.

The construction industry leads the pack with 2975 businesses going under, or 27 per cent of all insolvencies, in the past year, followed by accommodation and food services with 1667 insolvencies or 15 per cent.

Nearly every sector of the economy has registered a jump in insolvencies compared with 2022-23. Only the mining sector recorded a slight dip in busts.

Two hundred arts and recreation businesses entered administration in 2023-24 compared with 149 in the prior year, while 768 retail businesses went under in the year compared with 540 in 2022-23.

Alongside relatively unknown small businesses, a sweep of major companies collapsed throughout the year, including home goods retailer Godfreys Group, which went bust in January after nearly a century of trading.

An administration process does not automatically mean the end of a business, with some able to successfully restructure and continue trading.

Mr Beech said he remained optimistic, despite the headwinds hitting business.

“I’ll always be an optimist, but gee, it gives you some doubt as well,” he said.

“But I think the other thing about wages going up, that helps people to be able to afford to go out.

“I’m quite optimistic people still want to go out and eat.”