Major bank’s huge move on rates

Written by admin on August 29, 2024

A major bank has lowered its fixed rates for thousands of Aussies with home loans, following renewed hope of a rate cut after inflation slightly eased.

St George bank announced a range of owner occupied and residential investment homes were covered by the changes, effective from Thursday.

Owners on a one year fixed rate loan with principal and interest will now be charged 6.39 per cent per annum on their loan – a 0.45 per cent drop from the old rate.

Customers on a five-year fixed rate loan have received a 0.75 per cent drop.

This means they will now be subject to a rate of 6.19 per cent instead of the initial 6.94 per cent.

“Fixed rates may appeal to customers looking for certainty around their home loan repayments,” an alert from St George states.

“These latest changes provide competitive pricing options for both owner occupiers and investors.”

The new rates for owner occupier home loans with interest only now sit between 6.49 and 6.69 per cent, depending on the length of said loan.

However, the new packaged fixed rates only include the 0.15 per cent package discount and does not reflect the 0.20 per cent package discount initially announced by St George earlier this month.

The new rates follow inflation easing to 3.5 per cent, raising hopes a cash rate cut could be on the cards sooner in the year.

The Reserve Bank of Australia (RBA) will hold their next cash rate meeting on September 24.

The monthly July Consumer Price Index (CPI) revealed a drop from the 3.8 per cent recorded in June, along with underlying inflation – which removes large pricing movements – also eased by 0.3 per cent to 3.8 per cent.

Economists have said the change stems from recent cost of living relief, including a $300 energy rebate from the federal government progressively being rolled out.

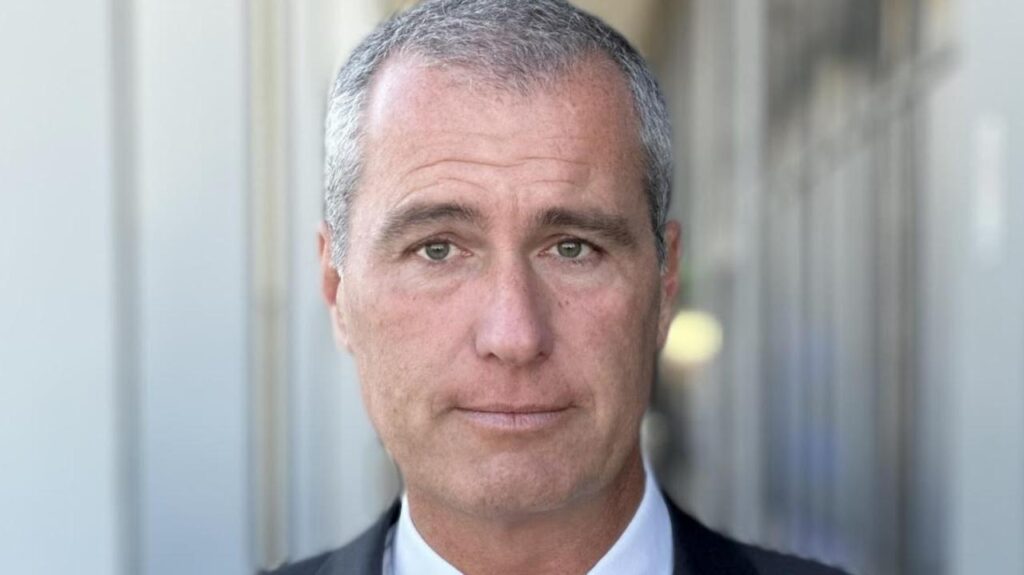

Warren Hogan, chief economist with Judo Bank, said the rebate had helped reduce inflation for now, but warned it was not a long-term solution.

“The subsidies aren’t real. They’re a government intervention,” Mr Hogan told Sky News.

“It’s good for cost of living and it’s real in people’s pockets.”

But he said if the rebate was removed from the calculation of the CPI, inflation was not going down, “it’s going sideways”.

“I think the only way they’re going to get a rate cut in this year is if something completely out of left field happens.”