Key issue driving state’s housing crisis

Written by admin on September 10, 2024

With housing targets looking increasingly out of reach, one state is eyeing off a plan spearheaded by a Dutch city to combat the crisis.

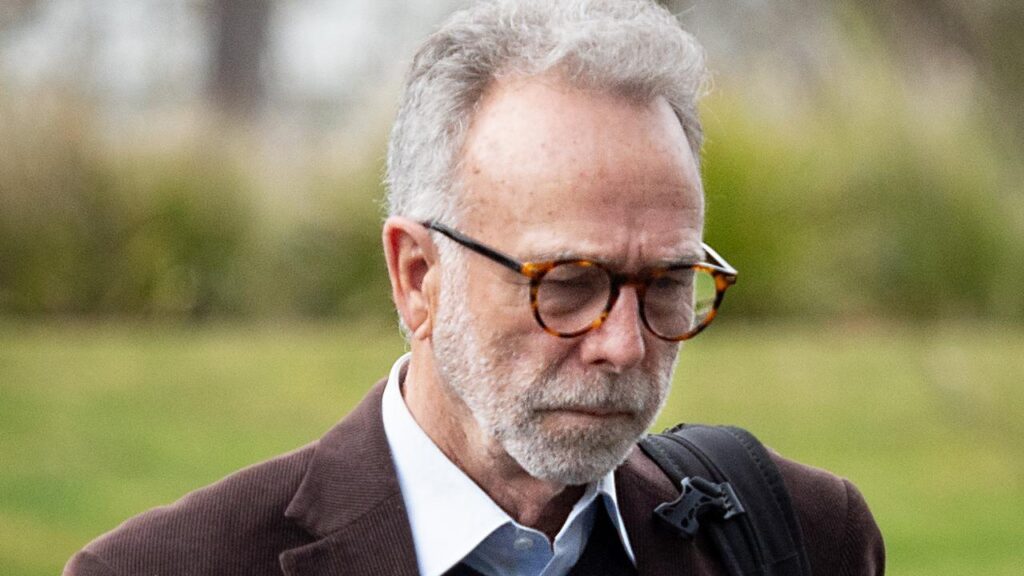

Speaking at a property summit in Sydney on Tuesday morning, NSW Planning Minister Paul Scully announced the state government would investigate pre-purchasing land and acting as a finance guarantor.

“A similar scheme has been operating in the Netherlands for 30 years,” Mr Scully said.

“In that time, they’ve produced thousands of homes and never called on the Dutch government for back up.”

The greater Sydney area is predicted to receive one million more people by 2041, as the state as a whole welcomes 85,000 new people every year.

“We are supporting greater infill development as it is cheaper to deliver than endless greenfield development and it’s better for the environment,” Mr Scully said.

“Sydney is one of the least dense cities in the world, it ranks at 859.”

The state government has been trying to create more density with a host of schemes, including a shake up of transport in Sydney, the Illawarra, Hunter and Central Coast which should make 170,000 new homes an attractive prospect in and around transport hubs over the next 15 years.

Seven other stations have been given “accelerated precinct” status, which should speed up the delivery of 60,000 new homes.

But those new builds are stymied by building inflation outpacing wider inflation; the average new home in New South Wales has gotten $19,000 more expensive in the past year because of higher materials and labour costs.

The cost of construction has snowballed 40 per cent in the past five years.

The Minister says a financing guarantee scheme through the state can more directly support the housing industry, increase the viability of housing projects and speed up the construction of new homes.

“We’re committed to speeding up approvals, making it easier for projects to move through the housing pipeline and reach completion,” he said.

While the state government seems keen to take a lead from the Dutch system, Mr Scully was not singing from the songbook of federal Treasurer Jim Chalmers, or national Labor president Wayne Swan. In the past two weeks Mr Chalmers has said the Reserve Bank is “smashing the economy”, and former Treasurer, Mr Swan, said the RBA was “punching itself in the face”.

“The ongoing housing shortage across Australia contributes to these inflationary pressures, making it hard for the RBA to avoid raising interest rates,” Mr Scully said on Tuesday.