Inflation rebounds in April heightening rate cut concerns

Written by admin on May 29, 2024

Inflation re-accelerated last month, compounding the challenge the Reserve Bank faces in taming simmering price pressure and delivering interest rate relief to cash strapped borrowers.

The monthly consumer price index rose to 3.6 per cent in the 12 months to April, the Australian Bureau of Statistics said on Wednesday, outpacing an expected increase of 3.4 per cent.

Trimmed mean inflation – the RBA’s preferred measure of prices which strips out volatile items like petrol – was steady at 4.1 per cent.

Despite a broader slowdown in household consumption, the hotter-than-expected inflation reading will add to concerns that price pressures and economic activity are re-intensifying.

Prior to the release, economists had warned that the monthly indicator would only provides a partial update of consumer prices.

Indeed, given April’s figures were heavily skewed towards goods, rather than more stubborn services prices, the reading is likely to underrepresent the actual inflation rate.

By itself, Wednesday’s result won’t change the timing of if and when the RBA can start to lower interest rates, which affect variable mortgages and other loans.

However, the result is likely to stoke fears that the RBA may need to deliver another rate hike, which governor Michele Bullock has not ruled out, or at the very least further delay rate cuts. Markets have not fully priced an interest rate cut until May 2025.

Among the most significant contributors to the annual increase were housing costs, with rents jumping 7.5 per cent as vacancy rates held at near-record lows, while the cost of home building also remained elevated at 4.9 per cent.

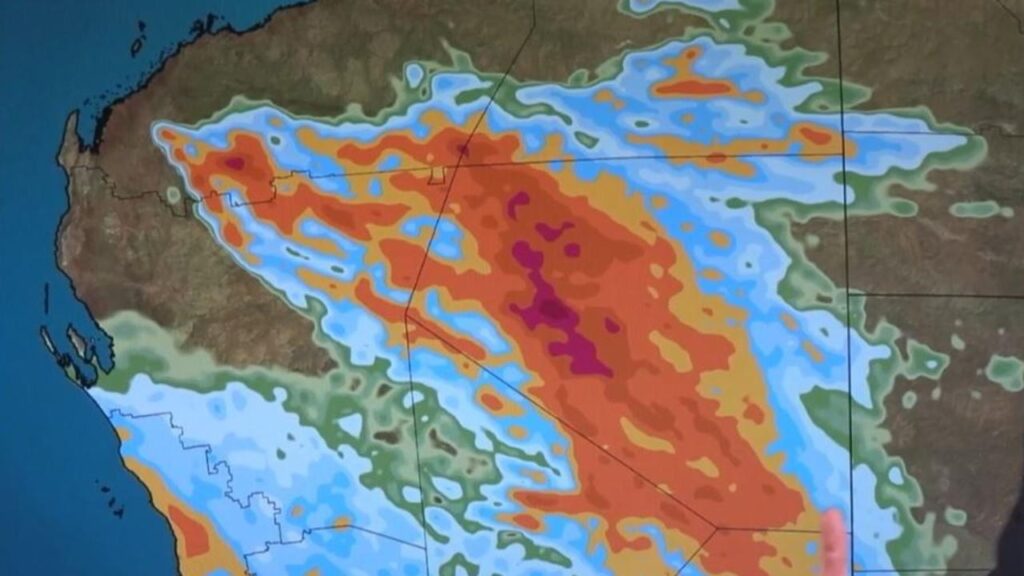

Food and vegetable prices recorded their strongest annual increase since April 2023, up 3.5 per cent, with unfavourable weather conditions driving price hikes everything from berries to broccoli, the ABS said.

Similarly, petrol prices re-accelerated across the month to be 7.4 per cent higher on an annual basis as motorists were slugged at the bowser.

After health insurers delivered an average annual premium increase of 3 per cent – the highest in five years – health inflation jumped by 6.1 per cent.

Electricity prices also rose by 4.2 per cent in the 12 months to April, however, had it not been for existing power bill subsidies, prices would have soared by 13.9 per cent over the same period.

Having peaked at 8.4 per cent in December 2022, inflation steadily retreated in the following 12 months but has since stalled at roughly 3.5 per cent, demonstrating the difficulty the RBA, like other central banks, has in achieving the last mile of its inflation fight.

It is expected that the $300 household power bill rebate unveiled in the May budget to lop half a percentage point off measured headline inflation, however economists have cautioned that the saving could fuel spending elsewhere in the economy, adding to inflationary pressures.

Read related topics:Reserve Bank