‘Fiercely competitive’: Woolies boss to sector probe

Written by admin on November 18, 2024

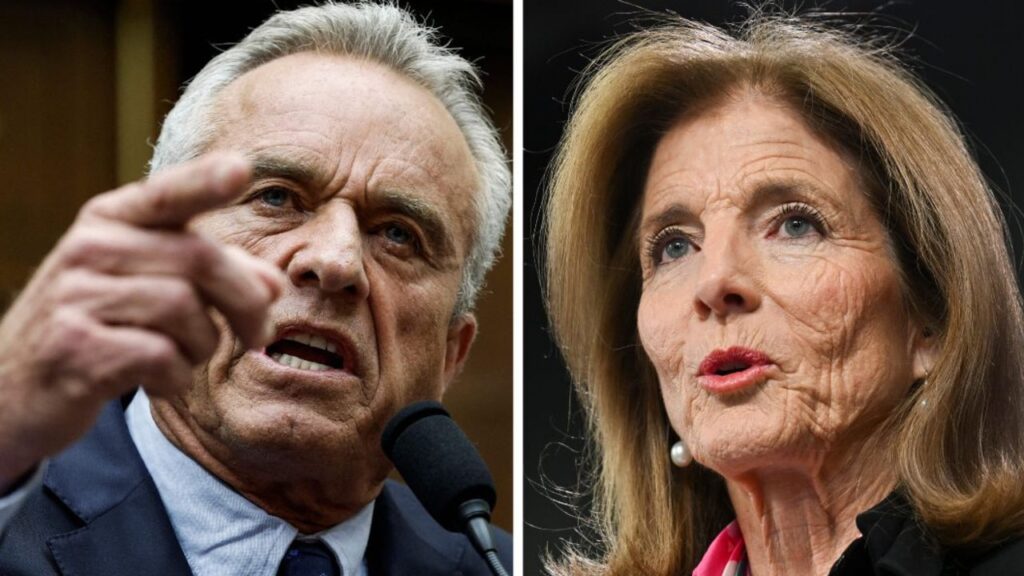

New Woolworths boss Amanda Bardwell has told Australia’s consumer rights watchdog inquiry the country’s supermarket sector is “fiercely competitive”.

Ms Bardwell entered the chain’s top job in September, taking over from long-time chief executive Brad Banducci, who stepped down after a run of public relations blunders earlier this year.

The Australian Competition and Consumer Commission is investigating the sector amid concerns around price setting practices and market concentration.

After 10 days of hearings with smaller players, Ms Bardwell fronted a public hearing on Monday alongside other Woolworths executives, where she was questioned by counsel assisting the ACCC, Naomi Sharp SC.

Ms Sharp asked the supermarket boss if she thought her sector was “fiercely competitive”.

“It is fiercely competitive,” Ms Bardwell replied.

“We are a substantial part of the market overall, which is dramatically changing and we compete every single day for customers to choose to shop with us.”

The Woolworths chief said that while Coles was a “major competitor”, she pointed to other retailers and e-commerce firms that had blurred sector lines.

Amazon, for example, had relatively recently started offering groceries.

“Coles is certainly a major competitor among with many others we talked about this morning, including Aldi playing a very important role,” Ms Bardwell said.

“Costco, Amazon, Chemist Warehouse, now Bunnings as well, all of those compete.”

The Albanese government launched a draft of a new grocery code in September after the ACCC announced it was taking legal action against both Woolworths and Coles.

Anthony Albanese at the time did not rule out if Costco or Amazon would be bound by the new code, but said the issue would be hashed out in further examination.

Ms Bardwell and her fellow executives also denied charges that Woolworths engaged in land banking after a redacted corporate document said the supermarket bought land for “strategic reasons”, rather than development.

More Coverage

Metcash, which owns IGA and Foodland, told a senate inquiry earlier this year the big supermarkets were blocking out competitors by buying up sites without developing them.

Both Woolworths and Coles took a different view, telling the same inquiry they were strategic purchases for longer-term planning.

But the inquiry said the companies were describing land banking practices.

Read related topics:Woolworths