Australian Baby Boomers reveal how much they really paid for their first homes

Written by admin on May 29, 2024

Australian Baby Boomers have revealed how much they bought their first homes for and whether they really think it is more difficult for young people to get into the property market today.

The older generation of homeowners were stopped on the streets of Sydney and asked how much they paid as first homebuyers and if they had any advice for Millennials and Gen Zers hoping to buy their own homes.

The videos were shared to TikTok by property finance platform, Coposit, with the answers leaving many viewers stunned.

One 72-year-old woman revealed she paid $82,000 in 1985 for a one-bedroom house, saying the price was relative to what she was earning and what she could afford at the time.

“I was just lucky to have that house now 40 years later, otherwise I wouldn’t be able to afford to buy a house at all. I paid it off a long time ago,” she said.

The woman said she knew of people her age who were having to now live in their cars because Sydney had become so “overpriced”.

The Baby Boomer said that, these days, in order for a young person to be able to buy they likely need to be willing to share, pool their resources or “maybe not live so lavishly”.

“Maybe you have to give up the odd coffee and avocado toast,” she said.

“I saved, I worked hard for what I had. I had two jobs, I had three jobs at one time. But it was affordable within what I was earning.”

However, she also agreed that it was “much harder now” for young people to get into the property market.

“I think we had jobs, we had opportunity. It was a very different time, but we’re living in a time where global greed is at its worst,” she said.

Another couple revealed they paid $28,000 for their first home 48 years ago. The most recent home they bought cost about $550,000, but its value has increased to over $1 million in just 10 years.

With their first home, they were able to buy it with a 30 per cent deposit, saying it was “easy when we were young”.

“It was so much easier then, it’s terrible now. It’s so hard to get one,” the woman said.

Another man said he bought his first home 16 years ago for $200,000, adding that he was “ashamed to say” it was now worth five or six times that amount.

He said the way housing prices have risen is making like “impossible” for his children.

“You are talking to an old, pretty left winger here who has pretty negative feelings about the way properties are basically dealt with in general. I think it is a really f**ked up disaster, quite frankly. It’s just awful,” he said.

“I hate that people have to pay so much in rent. I think it destroys their lives in a horribly insidious way and it affects every aspect of their life.”

His advice to young people would be to “get the f**k out of Sydney”, saying it is one of the main practical alternatives left if they want to be able to buy a house.

Another man who bought a home for $45,000 in 1985 said, at the time, that was considered a “fairly substantial amount of money” when considering the average income.

He also said that interest rates were around 13 and 14 per cent at the time.

“I can remember going through supermarkets and having to put things back,” the man said.

He revealed he worked in defence force, noting that, while the job was secure, the cash flow wasn’t and that meant a lot of people in that line of work were close to the poverty line.

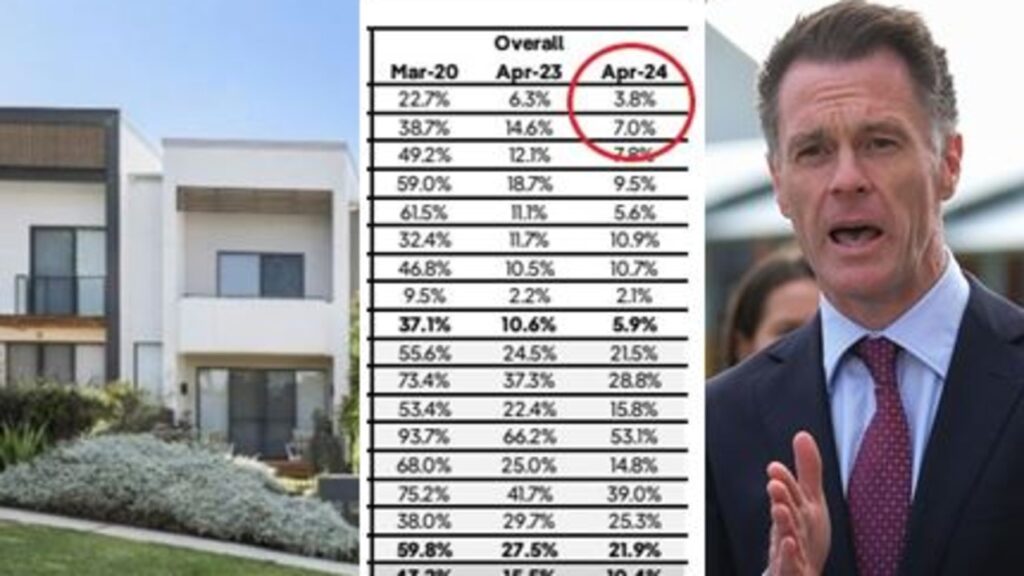

Despite differing opinions, data shows that buying a home now compared to the 80s is a completely different ball game.

In 1984, the average Australian could buy a home that cost 3.3 times their annual income. It is now around 10 times what the average person earns in a year, according to Finder.

Research showed that in 2023, the average home cost around $920,100, with the average income sitting at $90,896.

In comparison, in 1984 the average home cost $64,039, against an average income of $19,188.

More Coverage

Finder money editor, Richard Whitten, said the “numbers don’t lie”, saying young Aussies who think ‘Boomers had it better’ are right.

“While home buyers in the 80s and early 90s were hit with punishingly high interest rates, house prices were much lower,” he wrote.

“Buyers back then had to borrow less, save smaller deposits and spend less of their income on housing.”