Teen buys three investment properties in less than a year – with no cash from mum and dad

Written by admin on August 13, 2024

An entrepreneurial Sydney teenager has gone up a property shopping spree, snapping up three investments in less than 12 months – and without taking cash from mum and dad.

Cristian Caponi became interested in real estate after coming across the famed best-selling book Rich Dad Poor Dad by Robert Kiyosaki when he was just 15.

“It’s a bit of a cliche book but it covers the basics and it had me hooked,” Mr Caponi told news.com.au.

Four years on, the 19-year-old has managed to amass a burgeoning portfolio of properties in high-growth locations and is now in the market for his fourth investment.

But none of Mr Caponi’s properties are in his home town of Sydney, given how unaffordable real estate in the Harbour City is.

Instead, he turned his focus to a hotspot almost 4000 kilometres away.

Why the west is best

After high school, Mr Caponi bucked the popular graduate trend of going off to university and landed a job as a sales associate at a local real estate agency.

Eager to crack into the property market, he also opted against buying a home for himself for now, instead prioritising investing.

And after conducting plenty of research, he set his sights on a city he’s never even been to.

“Perth had the best prospects,” he said of his decision to focus on the west coast.

“When I was researching, it ticked so many boxes – migration and more affordable housing were the big ones.

“So, I bought a one-bedroom unit in Fremantle [in Perth] in July last year, which was very cheap at just $190,000.”

It was an off-market sale, meaning the modest apartment wasn’t listed for sale on property websites, and a bit of a fixer-upper, so he managed to secure it for an enticing price.

“I did a bit of interior work, just cosmetic stuff that didn’t cost much. The location is fabulous and that’s what really appealed to me,” he said.

While Mr Caponi had been diligently saving for some time, he decided not to use his own cash for the almost $40,000 deposit, with his parents going guarantor instead.

“I wanted to save that money to fund a deposit on a second property,” he explained.

He took his second step up the property ladder just three months later, buying a one-bedroom unit, also in Perth, in the suburb of Langford for $247,000.

For his third purchase, he drew equity from the second investment, which had risen rapidly in value, to cover the deposit on a two-bedroom villa in Swan View, which he snapped up in February.

In the 12 months since he first bought, he has also managed to pay down enough of the loan on his first property to remove his parents as guarantor.

His portfolio is positively geared, meaning the kitty of rental income covers his mortgage repayments and ongoing expenses like council rates and rental management fees.

While he didn’t receive a cash handout from his parents, he concedes that having them go guarantor sped up his ability to buy multiple properties in a short space of time.

And Mr Caponi still lives at his family’s home in Sydney’s inner-west so that he can continue saving as much money as possible.

“I think even if I was renting somewhere on my own, I would still be able to invest because I’m a pretty frugal person,” he said.

Mr Caponi is now preparing to start work as a buyer’s agent, sourcing properties for those looking to purchase, and has begun running education seminars and workshops for other young investors.

“Right now, my main long-term goal is to help people invest in property, but not only that, to put myself in a good financial position.

“I don’t really have a set target. I would love to get 10 properties just to have that there as a bit of a trophy.”

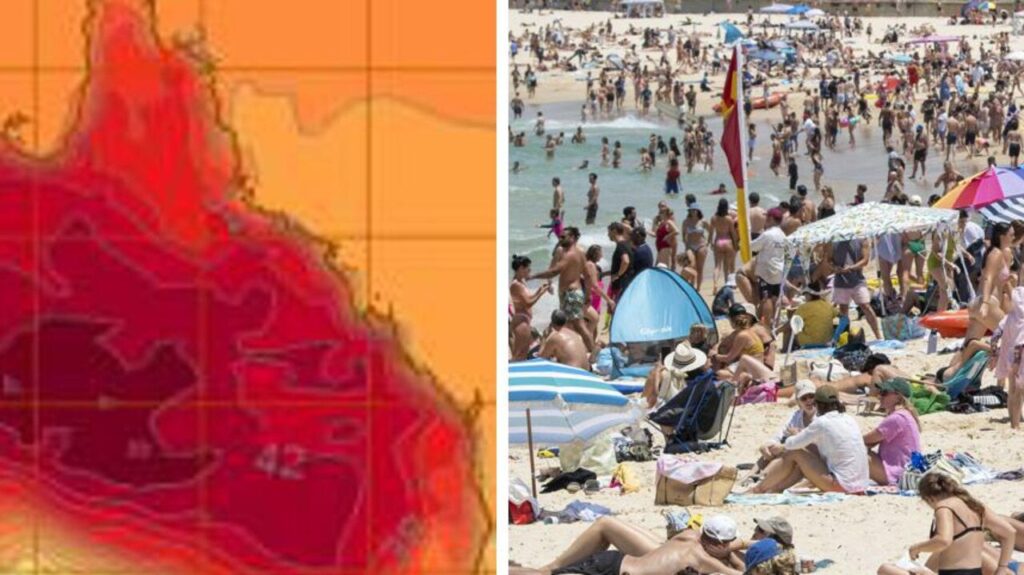

Perth running red-hot

Perth’s property market has boomed over the past few years, with the median house price surging by 23.1 per cent to $790,000 in the past 12 months alone.

The unit sector has performed just as strongly, with the median price of $530,000 leaping by a staggering 19.1 per cent.

Extremely high demand continues to clash with historically low levels of supply, putting intense upward pressure on values.

Real Estate Institute of Western Australia boss Joe White said units are increasingly popular given they provide a more affordable entry point to the market, particularly close to the Perth CBD.

“The unit market was slower to respond to market conditions [last year], and prices were fairly stable over 2023, but growth has accelerated this year and seen it equal the previous record,” Mr White said.

“More price growth is expected over 2024, which will be welcome news for unit owners.”

The average time it takes to sell a unit has also plunged to record lows, with most new listings being quickly snapped up, he added.

Like much of the rest of the country, Perth’s rental market has been running hot in recent times.

The median weekly asking rent for a unit is currently $620, which is up by 17 per cent in the past 12 months.

More Coverage

First property is a 1 bed, 1 bath, 1 car. Purchased in Fremantle off market for $190,000 and rents for $410 a week. That is valued now at $280,000.

Second property is a 1 bed, 1 bath, 1 car. Purchased in Langford, Perth for $250,000 and rents for $430 a week and is now valued at $400,000.

Third property is a villa with 2 bedrooms, 1 bath, 1 car. Purchased for $300,000 near Bassendean and rents for $480 a week and is revalued for $375,000.

Read related topics:Sydney